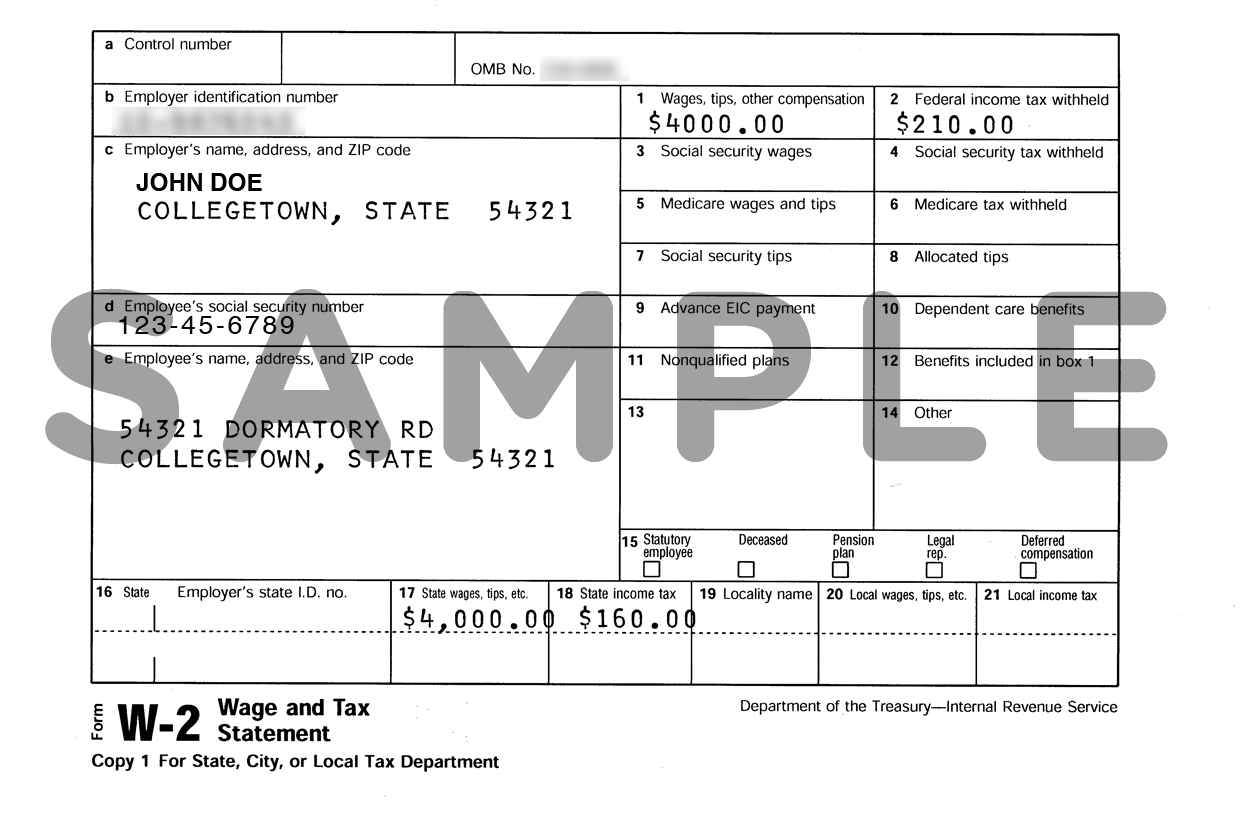

For more detail, see the IRS Form W-2 instructions on IRS.gov. Knowing not only the amount of spouse’s income, but the type of income is an important first step in determining income. Using these boxes on a W-2 is critical in properly determining the income of a spouse. While the same income subject to Medicare tax will be subject to Social Security tax, the amount in Box 3 could be lower than the amount in Box 5 depending on whether the employee’s income is above the wage base limit. The difference in Boxes 3 and 5 is that the Social Security Tax has a wage base limit, meaning only earnings up to a certain point are taxed. The income subject to Medicare tax in Box 5 will also be subject to Social Security tax. Box 5 is the most thorough listing of income.īox 3 reflects income subject to Social Security tax. Income not subject to federal income tax includes employee contributions to a SIMPLE retirement account or other elective deferrals, which will be taxed later on. This is the amount subject to Medicare tax. The amount in Box 1 is also going to be subject to Social Security and Medicare taxes, which means it will be included in Boxes 3 and 5.īox 5 includes income subject to federal income tax (Box 1) as well as income that is not subject to federal income tax. Box 1 does, however, include Roth contributions. It does not include elective deferrals, such as 401(k) or 403(b), or contributions to a SIMPLE retirement account. This box shows the total wages, tips, and other compensation paid to the employee during the year. It is important to understand how these boxes are different to properly determine the income of an opposing spouse.

Paycor Stadium: ESPN/ABC: 18 January 7/8 TBD: New England Patriots: W2 New. Box 5 includes income subject to Medicare tax. Available 24/7, you can use our automated telephone banking to hear your account balances and transactions, make transfers and report lost or stolen debit cards. Select the online W-2 statement option through myNKU Employee Self-Service no. Box 3 includes income subject to employee Social Security tax. Box 1 includes income subject to federal income tax. However, depending on the level and source of income, the amount in these three boxes could be very different. In some cases, the amounts in those boxes are the same. “Wages, tips, and other compensation,” “Social security wages,” and “Medicare wages and tips” do not appear to be all that different. Knowing the differences in Boxes 1, 3, and 5, on a W-2 is important in determining income. Know Your W-2 Form: Family Lawyers Know Income Determination is Critical for Spousal and Child Support Pre-tax contributions to a 401k or 403b will not show in Box 1 but will be in Box 3 and 5 amounts.

W-2 Box 1 is the amount of pay subject to income tax.

0 kommentar(er)

0 kommentar(er)